Unleashing the Power of UPI: Revolutionizing Digital Payments in India

Just a decade ago, the majority of transactions in India were conducted using hard cash, and there was widespread hesitation when it came to making payments with cards. Can you recall those days when receiving candy instead of money was a common occurrence? However, right before our eyes, a digital payment revolution unfolded, completely transforming the way we make payments. It has made the process hassle-free, stress-free, secure, and incredibly simple.

Everyone now accepts UPI, from cab drivers/ auto rikshaw driver to valet parking, vegetable vendors to toll payments, electricity bills to broadband connection. Even our favorite chai & samosa (Indian famous snacks) corner accept UPI payments, which may seem unbelievable in country like India which is deeply conservative and traditional.

An example of India’s captivation and proficiency with technology solutions to real policy problems, the UPI has made the world take notice of India’s innovation abilities.

The revolutionary concept is not just reinventing the payment infrastructure in India

but has also emerged as a case study for other countries in building a real-time payment system that is efficient, simple, and scalable.

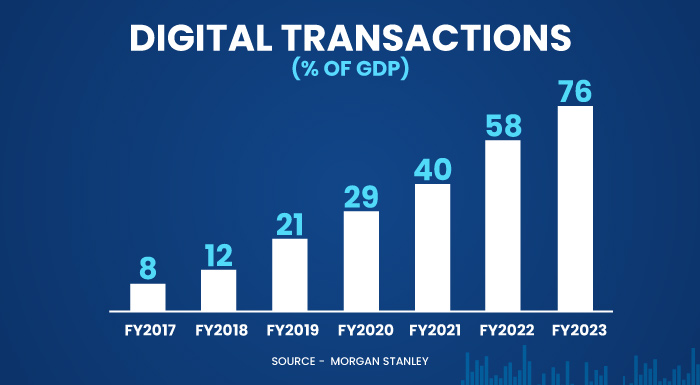

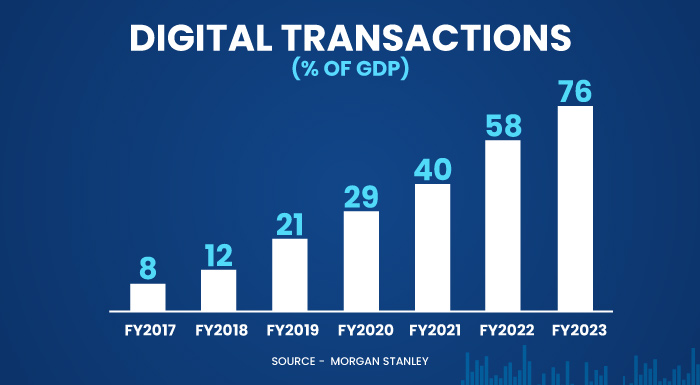

You can access the esteemed organization’s recent analysis report on India’s digital transaction graph over the past decade.

What is UPI :

UPI full form is Unified Payments Interface. It was a significant milestone in India’s journey towards a cashless economy. This innovative platform allows individuals to utilize their smartphones as virtual debit cards, enabling seamless and secure transactions. With UPI, users have the power to effortlessly send and receive money, ushering in a new era of digital financial convenience. Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

What makes UPI unique?

- Instant Money Transfers: Enjoy the convenience of transferring funds instantly through your mobile device, anytime, anywhere, even on weekends and holidays.

- Consolidated Banking: Access multiple bank accounts through a single mobile application, streamlining your banking experience.

- Secure Single Click Authentication: platform adheres to regulatory guidelines while offering a robust and seamless single-click payment feature, ensuring enhanced security.

- Virtual Customer Address: With our Pull & Push feature, you can conduct transactions without entering sensitive details like card numbers, account numbers, or IFSC codes, providing additional layers of security.

- QR Code Integration: Simplify your payments by scanning QR codes, eliminating the need for carrying cash or making exact change for cash on delivery orders.

- Merchant Payments Made Easy: Make payments to merchants effortlessly using a single application or in-app payments, enhancing convenience and efficiency.

- Diverse Payment Options: Pay utility bills, make over-the-counter payments, and utilize QR codes for quick and convenient transactions such as scan-and-pay.

- Streamlined Donations and Disbursements: Seamlessly manage donations, collections, and disbursements, ensuring scalability for your financial activities.

- Mobile Complaint Resolution: Easily raise complaints directly from the mobile application, enabling quick and efficient resolution of any issues you may encounter.

UPI Current Landscape:

The wheels of change have already been set in motion for the Indian economy. In January 2023, an astounding eight billion transactions, equivalent to 800 crores, were conducted on the Unified Payment Interface (UPI), amounting to a staggering value of nearly $200 billion (approximately Rs. 2 lakh crores). According to the National Payments Corporation of India (NPCI), the governing body responsible for UPI, digital payments now constitute a remarkable 40% of all financial transactions in the country. This transformative shift signifies a substantial departure from India’s traditional reliance on cash, heralding the dawn of a new era in its economic landscape.UPI Core Pillars:

India has successfully constructed a domestic instant payment system that has transformed commerce and brought millions of individuals into the formal economy. This achievement was made possible through a combination of government initiatives and a strong Public-Private Partnership. Through this network, India has demonstrated, on an unprecedented scale, how rapid technological innovation can have a transformative impact on developing nations, driving economic growth. India aims to export this public-private model and position itself as an incubator of ideas that can uplift poorer nations worldwide. At the core of this endeavor lies the renowned JAM trinity – Jan Dhan Accounts, Aadhar, and Mobile – three pillars that have revolutionized India’s entire economic ecosystem. The first pillar, PM Jan Dhan Yojana, was launched with the objective of achieving financial inclusion by ensuring that every adult Indian has access to a bank account. As of 2022, an impressive 46.25 crore bank accounts have been opened, with 56% being held by women and 67% established in rural and semi-urban areas, resulting in a total of Rs. 1,73,954 crores. The second pillar, Aadhar, has transformed identity services in India. Aadhar ID serves as a digital authentication tool, utilizing either two-factor authentication or biometric IDs. Aadhar-based authentication has become instrumental for institutions such as banks and telecom companies. Today, 99% of adults possess a biometric identification number, with over 1.3 billion IDs issued. These IDs have streamlined the process of opening bank accounts and form the foundation of the instant payment system. The third pillar focuses on Mobile, highlighting the remarkable digital innovation in India’s telecommunications sector. Following the disruptive entry of a private company in 2016, the cost of data plummeted by 95%. Consequently, every Indian gained affordable and easy access to the internet. This propelled sectors like e-commerce, food delivery, and OTT content to flourish in India. Most importantly, it made digital payment systems accessible even to the most remote regions and the most marginalized individuals in the country.Global outlook on UPI :

India’s digital payment systems, such as the Unified Payments Interface (UPI), are gaining global attention as they facilitate seamless cross-border transactions and reduce the costs associated with fund transfers and remittance payments. An excellent example of this is the recent integration between UPI and Singapore’s PayNow, enabling instant money transfers between residents of both countries through peer-to-peer payment systems. In addition to this development, the UPI payments facility is soon to be extended to inbound foreign travelers from G20 countries, allowing them to make merchant payments effortlessly. Moreover, non-resident Indians (NRIs) residing in selected international countries will have the opportunity to conduct transactions on UPI platforms without the need for an Indian mobile number. Indian digital payment systems, including UPI and RuPay, have expanded their reach to countries such as Singapore, UAE, Oman, Saudi Arabia, Malaysia, France, BENELUX markets (Belgium, the Netherlands, and Luxembourg), and Switzerland, among others. Furthermore, India has signed Memorandums of Understanding (MoUs) with 13 countries that aim to adopt the UPI interface for digital payments, highlighting the international interest in India’s robust payment infrastructure. UPI has revolutionized the way transactions are conducted, bringing convenience, accessibility, and security to millions of users. With its seamless integration across various platforms and its ability to facilitate instant, peer-to-peer transactions, UPI has become a catalyst for financial inclusion and economic growth. As India continues to embrace the power of UPI, we can expect further advancements and innovations in the digital payments landscape, ultimately shaping a more connected and cashless future for the nation. Click here to read above Blog in Japanese. Click here to read above Blog in Hindi.Ref. No – FB06231067

Related Blogs

Transforming the Future: How DigiLocker is Changing Document Storage & Access

"Discover the power of DigiLocker in this blog post. Explore how DigiLocker is changing the way we store and access documents, saving time and...

Insights on the Annual GALA 2023 Conference

The Annual GALA conference was held in Dublin Ireland form 13 to 15 March 2023. Fidel was a Sapphire sponsor as well as had an booth at the event....

भारत ने ‘अमृत काल’ में G20 की अध्यक्षता शुरू की

यह महामारी के बाद आर्थिक स्थिति में आए हुए सुधार के बाद की भू-राजनीतिक उथल-पुथल और अनिश्चितता का समय है। 1 दिसंबर, 2022 को भारत ने इंडोनेशिया से एक...